Learn Profit Margins in Ayurvedic Raw Material Trading Now

Table of Contents

Introduction

Thinking of starting an Ayurvedic raw material trading business or improving your existing margins?

This guide is tailored for small traders, herbal suppliers, and MSMEs looking to understand how profit margins work, what factors affect them, and how to calculate and grow them sustainably.

Whether you trade Ashwagandha, Giloy, Shatavari, or seasonal herbs, this article will give you a real-world profit lens.

What Is the Typical Profit Margin for Wholesale Ayurvedic Herbs Like Ashwagandha, Shatavari, or Giloy?

Profit margins in Ayurvedic raw material trading vary by product, quality grade, location, and buyer type. Here’s what typical gross margins look like:

- Ashwagandha (Dried Roots, Grade A): 15–25%

- Shatavari (Organic, Cleaned): 20–30%

- Giloy (Fresh Stem or Powdered): 10–20% (higher in monsoon demand)

- Brahmi, Neem, Tulsi: 18–28% depending on shelf life and format

Pro Tip: Margins are higher when sourcing directly from forest cooperatives or farmer groups and selling to end-use manufacturers or clinics.

How Do Seasonal Trends Affect Buying Price and Selling Margin in Ayurvedic Raw Material Trading?

Timing matters in herb trading. Most Ayurvedic raw material prices are seasonally driven due to agricultural cycles and health trends.

- Giloy & Tulsi: Demand spikes during monsoon (June–August) for immunity-boosting formulations. Prices go up; buy early and sell at peak.

- Ashwagandha & Shatavari: Post-harvest (Dec–Feb) is the best buying period when supply is high and rates are low.

- Amla, Haritaki: Summer-end and pre-winter storage drives bulk buying from manufacturers.

How This Impacts Margin:

- Buying in-season (harvest period) and selling during high-demand cycles increases profit margins by 10–15%.

- Delayed purchase = higher cost and lower resale markup.

Use Case: A small trader in Rajasthan stocked Giloy stems in May and sold them in July, earning a 22% margin instead of the usual 12%.

What Are the Major Costs That Reduce Your Profit in Ayurvedic Trading—Logistics, Storage, or Sourcing?

While Ayurvedic raw materials seem low-cost, profit can quietly erode due to these operational costs:

- Sourcing Costs:

- Middlemen markups (5–8%)

- Minimum purchase quantity from growers

- Middlemen markups (5–8%)

- Logistics Costs:

- Transport from farms to warehouse (₹2–5/kg)

- Inter-state permits, especially for forest produce

- Transport from farms to warehouse (₹2–5/kg)

- Storage & Spoilage:

- Improper storage can degrade herbs like Neem, Giloy, or Tulsi

- Pest infestation = complete loss

- Improper storage can degrade herbs like Neem, Giloy, or Tulsi

- Licensing & Compliance:

- Costs for AYUSH compliance, lab testing, or organic certification

- Costs for AYUSH compliance, lab testing, or organic certification

Margin Tip: Investing in basic warehousing (ventilation, pest control) can reduce spoilage loss by up to 10% annually.

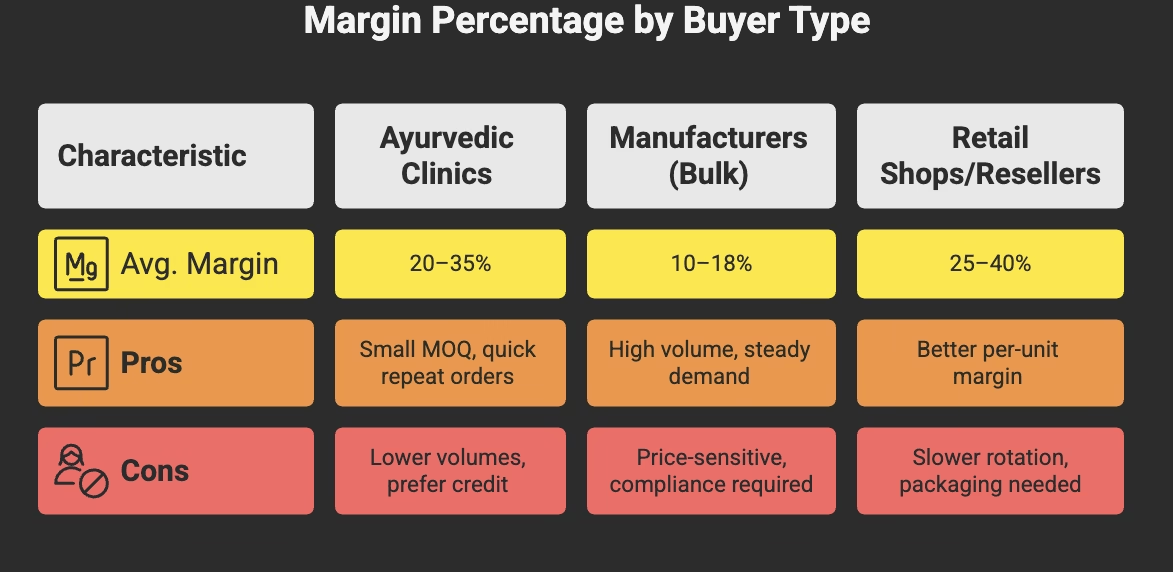

How Does Selling to Ayurvedic Clinics vs Manufacturers vs Retail Affect Your Margin Percentage?

Different B2B buyers offer different margin structures in Ayurvedic raw material trading:

Buyer Type

Avg. Margin

Pros

Cons

Ayurvedic Clinics

20–35%

Small MOQ, quick repeat orders

Lower volumes, prefer credit

Manufacturers (Bulk)

10–18%

High volume, steady demand

Price-sensitive, compliance required

Retail Shops/Resellers

25–40%

Better per-unit margin

Slower rotation, packaging needed

Strategy: Start with Ayurvedic clinics and shops to build volume, then negotiate bulk deals with manufacturers once your sourcing is stable.

Should Small Traders Offer Credit or Stick to Upfront Payment to Maintain Good Profit Margins?

Credit can grow your buyer network, but at the cost of your margins and cash flow. Here’s how to decide:

- Offer Limited Credit (7–15 Days) to repeat Ayurvedic clinic buyers with good repayment history.

- Avoid Credit for New Buyers unless referred or verified via B2B networks.

- Negotiate Volume Instead of Credit: Offer bulk discounts for upfront payments.

- Track Outstanding Dues: Use simple tools like Google Sheets or the Vyapar app to avoid losses.

Rule of Thumb: If your average margin is below 15%, don’t offer credit unless you’re compensated with higher order volume or exclusivity.

Conclusion

Understanding and optimizing profit margins in Ayurvedic raw material trading requires more than just good pricing. You need to:

- Track seasonal demand and plan purchases accordingly

- Calculate costs like logistics, spoilage, and storage that impact real profits

- Choose your buyer type strategically (clinics, manufacturers, or retail)

- Balance credit risk with volume and cash flow

With the right strategy and smart sourcing, even small traders can achieve sustainable margins of 20–30% in the Ayurvedic raw material sector.

Frequently Asked Questions (FAQ)

Q1: What is a good margin to aim for in Ayurvedic herb trading?

A: Aim for 20–30% gross margin, especially if you handle your own sourcing and delivery.

Q2: Which Ayurvedic herbs give the best profit margins?

A: Ashwagandha, Shatavari, Neem, and Triphala tend to have stable demand and good margins when bought in bulk.

Q3: When should I buy Ayurvedic raw materials to get the best price?

A: Buy post-harvest (Dec–Feb) for Ashwagandha and Shatavari; stock immunity herbs like Giloy before monsoon.

Q4: How do I calculate profit margin in this business?

A: Use the formula:

Profit Margin (%) = [(Selling Price – Total Cost) / Total Cost] x 100

Q5: Can I succeed in this trade without giving credit?

A: Yes. Many traders use upfront payment + sample-based selling to build trust before offering limited credit.

- Offer Limited Credit (7–15 Days) to repeat Ayurvedic clinic buyers with good repayment history.

Also Read,

- The Ultimate Guide: Working Capital Loans for Small Business (MSMEs) in 2025

Understanding the Impact of Payment Terms on Working Capital for Clinics

How Poor Inventory Management Hurts Working Capital in Pharmacies.

Want a Better Business Credit Score? Small Pharmacies Can Now Use UPI & Cards to Build It

Want a Better Credit Score? Use Small Daily Payments to Build Your CBIL (For Clinics & Pharmacies)

Case Study:How a Small Clinic Improved Its Working Capital Management